Mar 01

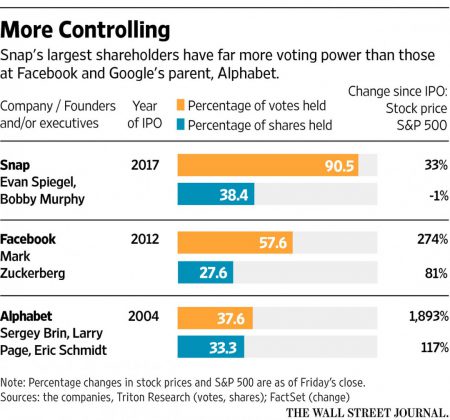

2017Snap Inc. set to price its IPO at $17 per share

It’s likely to be the biggest tech IPO this year, Wall Street watchers say.

Snap’s marketing of itself as not only a social network, but a company that makes wearable technology, cameras and glasses pits it against some more established

companies, Wallace said.

Apr 17

2014Nov 06

2013Bloomberg Surveillance

Tesla Valuation Is Temporarily Out of Step

Twitter Is More Like Pandora Than Facebook

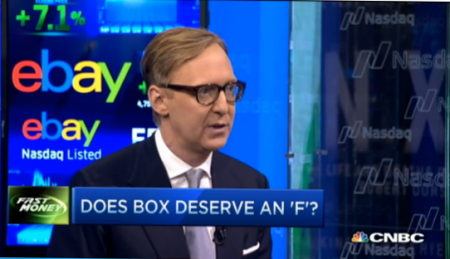

Rett Wallace, founder & CEO at Triton Research, discusses Twitter’s valuation and looks at what we may see in forward guidance from the ECB. – Watch Video

Obama’s Opportunity to Reshape the Federal Reserve

Here’s Why Twitter Is More Pandora Than Facebook

![]()

May 17

2013

Investors and analysts discuss the initial public offering of Chinese e-commerce giant Alibaba, which priced shares at the top of its expected price range. R

Investors and analysts discuss the initial public offering of Chinese e-commerce giant Alibaba, which priced shares at the top of its expected price range. R

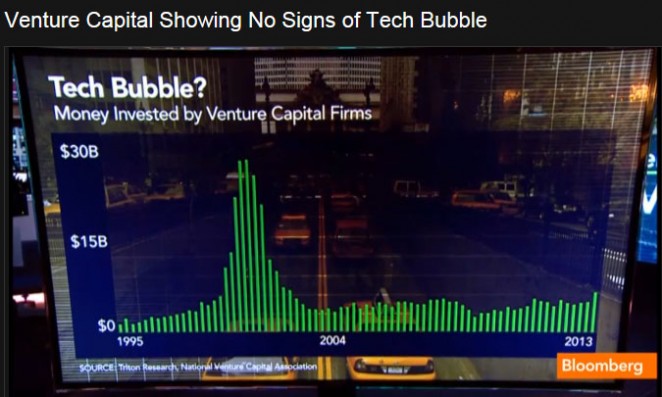

Triton Research Founder and CEO Rett Wallace discusses the markets and the spike in IPOs on Bloomberg Television’s “Bloomberg Surveillance.

Triton Research Founder and CEO Rett Wallace discusses the markets and the spike in IPOs on Bloomberg Television’s “Bloomberg Surveillance.