Mar 01

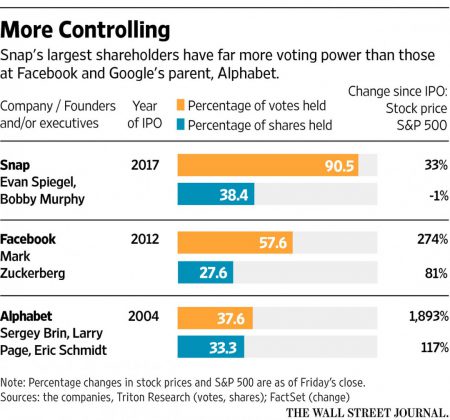

2017Snap Inc. set to price its IPO at $17 per share

It’s likely to be the biggest tech IPO this year, Wall Street watchers say.

Snap’s marketing of itself as not only a social network, but a company that makes wearable technology, cameras and glasses pits it against some more established

companies, Wallace said.

Feb 13

2017Jun 21

2016Apr 11

2016SecureWorks IPO Terms Set: 9m Shares at $15.50 – $17.50 / Share

SecureWorks filed an amended registration with the SEC for its IPO this morning. The company plans to sell 9mn shares and sees an offering price of $15.50 – $17.50 per share. SecureWorks will list on the Nasdaq under the ticker symbol “SCWX.”

Triton Research published a comprehensive Dossier on Atlassian Corporation on January 7, 2016. The Dossier includes a Triton Company Score, business model analysis, product analysis, bull vs. bear case scenarios, comparative analyses, questions for management, management biographies, a historical valuation assessment, and more.

Triton Company Score (avg. 6.58): Contact Triton Research for more details.

Company Description: Sells managed security services that help enterprises and other organizations outsource IT security and lower their need to acquire personnel, software, and hardware and is sold on a subscription-basis. The Company also sells one-time consulting services and security incident response services on an ad hoc basis.

Competitive Set: IBM, AT&T, Verizon, Optiv, Paladion Networks, The Herjavec Grou

Apr 08

2016Honest Co. Exploring Sale

Honest Co., the baby-products online retailer co-founded by actress Jessica Alba, is reportedly exploring a sale. The company previously hired Morgan Stanley and Goldman Sachs to work on an IPO. Investors in the company include Fidelity, Wellington Management, Lightspeed Venture Partners, General Catalyst Partners, and Institutional Venture Partners.

Honest Co. is a member of the Triton Research IPO Watchlist, a continuously updating database of companies we expect to either IPO or be acquired. The current IPO Watchlist is comprised of 104 companies organized by investment theme.

Mar 29

2016Spotify Raising $1bn Round

Spotify, the music streaming service, is reportedly raising $1bn in a debt financing round from TPG, Dragoneer and Goldman Sachs. Spotify last raised $526m at a $8.53bn valuation in June of 2015. Investors in the company include Accel, Discovery Capital, Founders Fund, GSV Capital and TCV.

Spotify is a member of the Triton Research IPO Watchlist, a continuously updating database of companies we expect to either IPO or be acquired. The current IPO Watchlist is comprised of 101 companies organized by investment theme.

Mar 18

2016Dropbox Shares Being Sold at a 34% Discount

Dropbox, the cloud storage company, has reportedly authorized a sale of its shares at a 34% discount to its most recent fundraising round. Shareholders are set to sell the shares on the secondary market at $12.60 each, down from the $19.10 price tag just two years ago. Dropbox last raised $250m at a $10bn valuation in January of 2014. Investors in the company include Sequoia Capital, Accel Partners, Goldman Sachs, Benchmark Capital, Greylock Partners, RIT Capital Partners and Valiant Capital Partners.

Dropbox is a member of the Triton Research IPO Watchlist, a continuously updating database of companies we expect to either IPO or be acquired. The current IPO Watchlist is comprised of 101 companies organized by investment theme.

Mar 16

2016Acacia Communications Dossier Published

Triton Research published a comprehensive Dossier on Acacia Communications on March 16, 2016. The Dossier includes a Triton Company Score, fundamental model, business model analysis, product analysis, bull vs. bear case scenarios, comparative analyses, questions for management, management biographies, a historical valuation assessment, and more.

Acacia Communications filed an S-1 for a $125m IPO on December 23, 2015. The company named Goldman Sachs, Bank of America and Deutsche Bank as joint bookrunners. Acacia Communications will list on the Nasdaq under the ticker symbol “ACIA.”

Company Description: Acacia Communications designs and sells high-speed, coherent transceivers and related components to network equipment manufacturers on a per module basis. The transceivers and components are used in fiber optic routers and switches by telecommunications and cloud service providers.

Triton Company Score (avg. 6.58): Contact Triton Research for more details.

Competitive Set: Finisar, Oclaro, Lumentum, ClariPhy, Coriant, InnoLight

Mar 09

2016WeWork Raising $780m Round

WeWork, the New York-based provider of shared office space, is reportedly raising $780m in a debt financing round valuing the company at $17bn. WeWork previously raised $969m in funding at a $10bn valuation. Investors in the company include Benchmark Capital, Harvard Management, Fidelity Investments, Goldman Sachs, T. Rowe Price, J.P. Morgan and Wellington Management.

WeWork is a member of the Triton Research IPO Watchlist, a continuously updating database of companies we expect to either IPO or be acquired. The current IPO Watchlist is comprised of 101 companies organized by investment theme.

Feb 23

2016Nutanix Holding Off IPO Pending Market Conditions

Nutanix, the network virtualization hardware company, is reportedly putting its IPO on hold until markets stabilize.

Triton Research published a comprehensive Dossier on Nutanix on January 11, 2016. The Dossier includes a Triton Company Score, fundamental model, business model analysis, product analysis, bull vs. bear case scenarios, comparative analyses, questions for management, management biographies, a historical valuation assessment, and more.

Nutanix filed an S-1 for a $200m IPO on December 22, 2015. The company named Goldman Sachs, Morgan Stanley, J.P. Morgan and Credit Suisse as joint bookrunners. Nutanix will list on the Nasdaq under the ticker symbol “NTNX.”

Company Description: Develops and sells turnkey data center appliances and software that virtualizes both computational and storage capabilities removing the need for a centralized SAN or NAS system (cloud computing in a box). The product is sold along with related maintenance services to enterprises largely through third-party channels.

Feb 22

2016Tanium Names New CEO

Tanium, a cybersecurity software company, has appointed co-founder Orion Hindawi as its new CEO. Mr. Hindawi was promoted from his position as CTO and takes over for his father, David Hindawi, who co-founded the company in 2007. Tanium raised $120m last September at a $3.5bn valuation, bringing its total funding to $302m. Investors in the company include Andreesen Horowitz, Franklin Templeton Investments, T. Rowe Price, IVP and TPG.

Tanium is a member of the Triton Research IPO Watchlist, a continuously updating database of companies we expect to either IPO or be acquired. The current IPO Watchlist is comprised of 104 companies organized by investment theme.

Feb 17

2016Twilio Expected to IPO Soon

Twilio, the cloud communications company that allows developers to add text, voice, picture and video to apps and other services is reportedly planning to go public soon. The company filed confidentially last year and is working with Goldman Sachs and J.P. Morgan. Twilio raised $130m last July at a $1bn valuation, bringing its total funding to $234m. Investors in the company include Fidelity, T. Rowe Price, Redpoint Ventures, Bessemer Venture Partners and Founders Fund.

Twilio is a member of the Triton Research IPO Watchlist, a continuously updating database of companies we expect to either IPO or be acquired. The current IPO Watchlist is comprised of 104 companies organized by investment theme.

Feb 05

2016Honest Co. Exploring IPO

Honest Co., the baby-products online retailer co-founded by actress Jessica Alba, is reportedly working with Goldman Sachs and Morgan Stanley on an initial public offering. The company raised $100m last August at a $1.7bn valuation. Investors in the company include Fidelity, Wellington Management, Lightspeed Venture Partners, General Catalyst Partners, and Institutional Venture Partners.

Honest Co. is a member of the Triton Research IPO Watchlist, a continuously updating database of companies we expect to either IPO or be acquired. The current IPO Watchlist is comprised of 104 companies organized by investment theme.

Feb 04

2016Jasper Technologies Acquired by Cisco for $1.4bn

Jasper Technologies, a software company that helps manage wireless connections for Internet-connected equipment, was acquired by Cisco for $1.4bn yesterday. Jasper, which has been on Triton’s IPO Watchlist since November 2014, was reportedly planning an IPO but decided to sell instead. Investors in the company include AllianceBernstein, Benchmark, Sequoia Capital, and Temasek Holdings. The $1.4bn sale price is approximately the price of Jasper’s latest private valuation.

Jasper Technologies is a member of the Triton Research IPO Watchlist, a continuously updating database of companies we expect to either IPO or be acquired. The current IPO Watchlist is comprised of 104 companies organized by investment theme.

Jan 11

2016Nutanix Dossier Published

Triton Research published a comprehensive Dossier on Nutanix on January 11, 2016. The Dossier includes a Triton Company Score, fundamental model, business model analysis, product analysis, bull vs. bear case scenarios, comparative analyses, questions for management, management biographies, a historical valuation assessment, and more.

Nutanix filed an S-1 for a $200m IPO on December 22, 2015. The company named Goldman Sachs, Morgan Stanley, J.P. Morgan and Credit Suisse as joint bookrunners. Nutanix will list on the Nasdaq under the ticker symbol “NTNX.”

Company Description: Develops and sells turnkey data center appliances and software that virtualizes both computational and storage capabilities removing the need for a centralized SAN or NAS system (cloud computing in a box). The product is sold along with related maintenance services to enterprises largely through third-party channels.

Triton Company Score (avg. 6.58): Contact Triton Research for more details.

Competitive Set: VMware, HP Enterprise, SimpliVity, Pivot3, Atlantis Computing

Jan 07

2016SecureWorks Dossier Published

Triton Research published a comprehensive Dossier on SecureWorks on January 7, 2016. The Dossier includes a Triton Company Score, business model analysis, product analysis, bull vs. bear case scenarios, comparative analyses, questions for management, management biographies, a historical valuation assessment, and more.

SecureWorks filed an S-1 for a $100m IPO on December 17, 2015. The company named Bank of America, Goldman Sachs and J.P. Morgan as joint bookrunners. SecureWorks will list on the Nasdaq under the ticker symbol “SCWX.”

Company Description: Sells managed security services to enterprises and other organizations on a subscription-basis that help customers outsource IT security and lower their need to acquire personnel, software, and hardware. The Company also sells one-time consulting services and security incident response services on an ad hoc basis..

Triton Company Score (avg. 6.58): Contact Triton Research for more details.

Competitive Set: IBM, AT&T, Verizon, Optiv, Paladion Networks, The Herjavec Group

Jan 04

2016Lyft Received $500m Investment from GM

Lyft, a U.S.-based ridesharing app, announced that it has received a $500m investment from GM. The investment is part of a wider-ranging strategic partnership that will include a rental program for drivers of the car-sharing service and the creation of an on-demand autonomous car network. The partnership also marks Lyft’s boldest declaration yet that it intends to operate with self-driving cars in the future.

GM’s investment is part of a larger funding round of $1bn for Lyft, which reportedly values Lyft at $5.5bn. The round already includes $100m from Saudi Arabia’s Kingdom Holding Company, Janus Capital Management, Rakuten, Didi Kuaidi and Alibaba. Lyft has now raised $2bn since it was founded in 2013.

Lyft is a member of the Triton Research IPO Watchlist, a continuously updating database of companies we expect to either IPO or be acquired. The current IPO Watchlist is comprised of 102 companies organized by investment theme.

Dec 17

2015SecureWorks Filed for a $100m IPO

SecureWorks Corp, a subsidiary of Dell Inc. that provides information security services, filed an S-1 with the SEC for a $100m IPO today. The company named Bank of America, Morgan Stanley, Goldman Sachs and J.P. Morgan as joint bookrunners. SecureWorks will list on the Nasdaq under the ticker symbol “SCWX.”

Company Description: Provides information security services focused on cyber attacks.

Competitive Set: FireEye, Palo Alto Networks, Symantec, Cisco, IBM, Hewlett Packard

Dec 07

2015Atlassian IPO Offering Now 22m Shares at $19 – $20/Share

Atlassian Corporation filed an F-1/A with the SEC today revising their IPO offering. The company will now sell 22m shares at an offering price of $19.00 – $20.00 per share. Atlassian previously planned to sell 20m shares at $16.50 – $18.50 per share. Atlassian will list on the Nasdaq under the ticker symbol “TEAM.”

Triton Research published a comprehensive Dossier on Atlassian Corporation on November 20, 2015 and updated that Dossier on November 30. 2015. The Dossier includes a Triton Company Score, fundamental model, business model analysis, product analysis, bull vs. bear case scenarios, comparative analyses, questions for management, management biographies, a historical valuation assessment, and more

Dec 01

2015Atlassian IPO Dossier Updated: Triton Score Unchanged

Triton Research revised our Atlassian Company Score to reflect the company’s amended registration with the SEC on November 27, 2015. The company plans to sell 20m shares and sees an offering price of $16.50 – $18.50 per share. Atlassian will list on the Nasdaq under the ticker symbol “TEAM.”

Triton Research originally published a comprehensive Dossier on Atlassian Corporation on November 20, 2015. The Dossier includes a Triton Company Score, fundamental model, business model analysis, product analysis, bull vs. bear case scenarios, comparative analyses, questions for management, management biographies, a historical valuation assessment, and more.

Nov 27

2015Atlassian IPO Terms Set: 20m Shares at $16.50 – $18.50 Per Share

Atlassian Corporation filed an amended registration with the SEC for its IPO on November 27, 2015. The company plans to sell 20m shares and sees an offering price of $16.50 – $18.50 per share. Atlassian will list on the Nasdaq under the ticker symbol “TEAM.”

Triton Research published a comprehensive Dossier on Atlassian Corporation on November 20, 2015. The Dossier includes a Triton Company Score, fundamental model, business model analysis, product analysis, bull vs. bear case scenarios, comparative analyses, questions for management, management biographies, a historical valuation assessment, and more.

Nov 21

2015Atlassian Dossier Published

Triton Research published a comprehensive Dossier on Atlassian Corporation on November 20, 2015. The Dossier includes a Triton Company Score, fundamental model, business model analysis, product analysis, bull vs. bear case scenarios, comparative analyses, questions for management, management biographies, a historical valuation assessment, and more.

Atlassian Corporation filed an S-1 for a $250m IPO on November 9, 2015. The company named Goldman Sachs and Morgan Stanley as lead bookrunners. Atlassian will list on the Nasdaq under the ticker symbol “TEAM.”

Company Description: Develops and sells software development and collaboration tools on a subscription and perpetual license basis along with related support and training services. The Company also runs a marketplace for 3rd-party vendors to sell extensions for the Company’s software.

Nov 19

2015Nov 17

2015Yirendai Filed for a $100m IPO

Yirendai Ltd., a Chinese marketplace for peer-to-peer personal loans spun out of CreditEase, filed an F-1 with the SEC for a $100m IPO. The company named Morgan Stanley, Credit Suisse and China Renaissance as joint bookrunners. Yirendai will list on the NYSE under the ticker symbol “YRD.”

Company Description: Online peer-to-peer lending marketplace that matches investors with individual borrowers.

Competitive Set: Lending Club, OnDeck, Prosper, SoFi, Zopa.

Nov 10

2015Match Group IPO Dossier Updated: Triton Score Revised LOWER

Triton Research revised our Match Group Company Score LOWER to reflect Match’s amended registration with the SEC yesterday. Match Group plans to sell 33.3m shares and sees an offering price of $12 – $14 per share. Match will list on the Nasdaq under the ticker symbol “MTCH.”

Triton Research originally published a comprehensive Dossier on Match Group on October 30, 2015. The Dossier includes a Triton Company Score, fundamental model, business model analysis, product analysis, bull vs. bear case scenarios, comparative analyses, management and director biographies, a historical valuation assessment, questions for management, and more.

Nov 09

2015Match Group IPO Terms Set: 33.3m Shares at $12 – $14 Per Share

Match Group filed an amended registration with the SEC for its IPO this morning. The company plans to sell 33.3m shares and sees an offering price of $12 – $14 per share. Match will list on the Nasdaq under the ticker symbol “MTCH.”

Triton Research published a comprehensive Dossier on Match Group on October 30, 2015, which is being updated to reflect today’s offering details. The Dossier includes a Triton Company Score, fundamental model, business model analysis, product analysis, bull vs. bear case scenarios, comparative analyses, management and director biographies, a historical valuation assessment, questions for management, and more.

Nov 09

2015Atlassian Filed for a $250m IPO

Atlassian Corporation filed an S-1 for a $250m IPO this morning. The company named Goldman Sachs and Morgan Stanley as lead bookrunners. Atlassian will list on the Nasdaq under the ticker symbol “TEAM.”

Company Description: Atlassian sells business collaboration software.

Competitive Set: Microsoft, IBM, Rally Software (CA Technologies), GitHub, Zendesk

Nov 07

2015Square IPO Dossier Updated

Triton Research updated our Dossier to reflect Square’s amended registration with the SEC on November 6, 2015. Square plans to sell 27m shares and sees an offering price of $11 – $13 per share. Square will list on the NYSE under the symbol “SQ.”

Triton initially published a comprehensive Square Dossier on October 27th, 2015. The Dossier includes a Triton Company Score, business model analysis, product analysis, bull vs. bear case scenarios, comparative analyses, management and director biographies, a historical valuation assessment, questions for management, and more.

Nov 06

2015Square IPO Terms Set: 27m Shares at $11-$13 Per Share

Square Inc. filed an amended registration with the SEC for its IPO today. The company plans to sell 27m shares and sees an offering price of $11 – $13 per share. Square will list on the NYSE under the symbol “SQ.”

Triton published a comprehensive Square Dossier on October 27th, 2015, which is being updated to reflect today’s offering details. The Dossier includes a Triton Company Score, business model analysis, product analysis, bull vs. bear case scenarios, comparative analyses, management and director biographies, a historical valuation assessment, questions for management, and more.

Nov 06

2015Square IPO Terms Set: 27m Shares at $11-$13 Per Share

Square Inc. filed an amended registration with the SEC for its IPO today. The company plans to sell 27m shares and sees an offering price of $11 – $13 per share. Square will list on the NYSE under the symbol “SQ.”

Triton published a comprehensive Square Dossier on October 27th, 2015, which is being updated to reflect today’s offering details. The Dossier includes a Triton Company Score, business model analysis, product analysis, bull vs. bear case scenarios, comparative analyses, management and director biographies, a historical valuation assessment, questions for management, and more.

Company Description: Square provides transaction services, software, and hardware that allow merchants to accept card payments. The Company also provides software services that manage back-office operations and also provides cash advances to merchants.

Competitive Set: PayPal, VeriFone, Shopify, Stripe, Adyen, Lightspeed, Clover (First Data)

Oct 16

2015Match Group Inc. Filed for a $100m IPO

Match Group Inc. filed an S-1 for a $100m IPO this evening. The company named J.P. Morgan, Allen & Company, and BofA Merrill Lynch as bookrunners. Match Group Inc. will list on the Nasdaq under the ticker symbol “MTCH.”

Company Description: Match Group operates a portfolio dating products including Match, OkCupid, Tinder, Meetic, Twoo, OurTime and FriendScout24.

Competitive Set: Zoosk, Parship, ElitePartner, eHarmony.com, Spark Networks (Jdate, ChristianMingle), , Hinge, Bumble, Blendr, MeetMe.com

Oct 16

2015Oct 16

2015Oct 15

2015Oct 14

2015Square Filed for a $275m IPO

Square Inc. filed an S-1 for a $275m IPO this afternoon. The company named Goldman Sachs, Morgan Stanley, and J.P. Morgan as lead bookrunners. Square will list on the NYSE under the ticker symbol “SQ.”

Company Description: Square sells point-of-sale and retail management software and hardware. Square also offers payment processing and marketing services, and operates the Square Capital small-business loan marketplace.

Competitive Set: Intuit, Apple, Clover (First Data), Adyen, Shopify, Revel Systems.

Oct 02

2015First Data IPO Dossier Updated: Triton Score Revised HIGHER

Triton Research revised our First Data Company Score higher to reflect First Data’s amended registration with the SEC yesterday. First Data plans to sell 160m shares and sees an offering price of $18 – $20 per share. First Data will list on the NYSE under the symbol “FDC.”

Triton published a comprehensive First Data Dossier on August 11, 2015. The Dossier includes a Triton Company Score, business model analysis, product analysis, bull vs. bear case scenarios, comparative analyses, management and director biographies, a historical valuation assessment, questions for management, and more.

Oct 01

2015SoFi Raised $1bn

Social Finance, the peer-to-peer (P2P) student loan startup, announced that it had raised a $1bn Series E round yesterday. This is believed to be the largest-ever equity funding in the financial technology space. SoftBank led the round and was joined by Third Point Ventures, Wellington Management, Institutional Venture Partners, RenRen, and Baseline Ventures. This raise is expected to delay SoFi’s IPO plans, as the company was previously speculated to go public in 2015.

SoFi is a member of the Triton Research IPO Watchlist, a continuously updating database of companies we expect to either IPO or be acquired. The current IPO Watchlist is comprised of 108 companies organized by investment theme.

Oct 01

2015First Data IPO Terms Set: 160m Shares at $18 – $20 Per Share

First Data Corp. filed an amended registration with the SEC for its IPO today. The company plans to sell 160m shares and sees an offering price of $18 – $20 per share. First Data will list on the NYSE under the symbol “FDC.”

Triton published a comprehensive First Data Dossier on August 11, 2015. The Dossier includes a Triton Company Score, business model analysis, product analysis, bull vs. bear case scenarios, comparative analyses, management and director biographies, a historical valuation assessment, questions for management, and more.

Sep 30

2015Avant Raising $325m

Avant, an online marketplace for consumer loans, raised $325m in an equity round led by General Atlantic. Other investors include Balyasny Asset Management and J.P. Morgan, as well as existing shareholders Tiger Global Management, August Capital, RRE Ventures and DFJ Growth. The round, which is expected to formally close in a few weeks, reportedly valued Avant at approximately $2bn.

Avant is a member of the Triton Research IPO Watchlist, a continuously updating database of companies we expect to either IPO or be acquired. The current IPO Watchlist is comprised of 108 companies organized by investment theme.

Sep 28

2015Didi Kuaidi Invested in Ola

Didi Kuaidi, China’s largest taxi-hailing app, announced today that it invested in Ola, India’s largest taxi-hailing app. Earlier this month Ola was reported to be raising over $500m at a $5bn valuation. Didi did not disclose the amount it is investing, but reports suggest it invested approximately $30m. The investment appears to confirm recent speculation that Didi is attempting to assemble a global alliance of the major car services that aren’t Uber. Did has previously invested in Lyft (U.S.) and GrabTaxi (Southeast Asia).

Didi Kuaidi and Ola are both members of the Triton Research IPO Watchlist, a continuously updating database of companies we expect to either IPO or be acquired. The current IPO Watchlist is comprised of 108 companies organized by investment theme.

Sep 26

2015Square Filing for IPO in Two Weeks

Square, the merchant services aggregator and mobile payment company, is reportedly planning to file an S-1 for its initial public offering within the next two weeks. A Fortune article out yesterday afternoon states that the company filed a confidential filing earlier this summer. This timing would allow Square to go public before the end of 2015. Goldman Sachs has been selected as the lead underwriter and Morgan Stanley and J.P. Morgan are also involved in the deal.

Square was last valued at $6bn in October 2014. Investors in the company include Government of Singapore Investment Corporation, Citi Ventures, Starbucks, Sequoia Capital and Richard Branson.

Square is a member of the Triton Research IPO Watchlist, a continuously updating database of companies we expect to either IPO or be acquired. The current IPO Watchlist is comprised of 108 companies organized by investment theme.

Sep 25

2015Triton Score Revised LOWER

Triton Research revised our Pure Storage Company Score lower to reflect Pure Storage’s amended registration with the SEC yesterday. Pure Storage plans to sell 25m shares and sees an offering price of $16 – $18 per share. Pure Storage will list on the NYSE under the symbol “PSTG.”

Triton Research published a comprehensive Dossier on Pure Storage on September 1, 2015. The Dossier includes a Triton Company Score, fundamental model, business model analysis, product analysis, bull vs. bear case scenarios, comparative analyses, management and director biographies, a historical valuation assessment, questions for management, and more.

Sep 24

2015Pure Storage Sets IPO Terms: 25m Shares at $16 – $18 Per Share

Pure Storage filed an amended registration with the SEC for its IPO today. The company plans to sell 25m shares and sees an offering price of $16 – $18 per share. Pure Storage will list on the NYSE under the symbol “PSTG.”

Triton Research published a comprehensive Dossier on Pure Storage on September 1, 2015. The Dossier includes a Triton Company Score, fundamental model, business model analysis, product analysis, bull vs. bear case scenarios, comparative analyses, management and director biographies, a historical valuation assessment, questions for management, and more.

Sep 21

2015First Data Targeting $3bn IPO

A Wall Street Journal report claims that First Data Corp. is planning to raise $3bn in its IPO. The offering is scheduled to kick off this week and will be the biggest U.S. listing so far this year. The IPO is expected to give First Data a stock market value of $20 – 25bn. Article Link.

Triton published a comprehensive First Data Dossier on August 11, 2015. The Dossier includes a Triton Company Score, business model analysis, product analysis, bull vs. bear case scenarios, comparative analyses, management and director biographies, a historical valuation assessment, questions for management, and more.

Sep 17

2015First Data Appoints New CFO

First Data today announced that Himanshu Patel has been appointed Chief Financial Officer for the company. Patel has served as First Data’s Executive Vice President of Strategy, Planning & Business Development since June 2013. The company’s IPO is expected within the week.

Triton published a comprehensive Dossier on August 11, 2015. The Dossier includes a Triton Company Score, business model analysis, product analysis, bull vs. bear case scenarios, comparative analyses, management and director biographies, a historical valuation assessment, questions for management, and more.

Sep 15

2015Ola Raising $500m at a $5bn Valuation

Ola, a mobile taxi booking marketplace in India, is reportedly raising over $500m at a $5bn valuation. The raise is expected to be finalized within the next two weeks, but $225m has already been committed from investors including Falcon Edge Capital, Tiger Global Management, and Softbank Corp. The company was last valued at $2.5bn in April when Ola raised $400m.

Ola is a member of the Triton Research IPO Watchlist, a continuously updating database of companies we expect to either IPO or be acquired. The current IPO Watchlist is comprised of 108 companies organized by investment theme.

Sep 11

2015First Data Will List on NYSE as “FDC”

First Data Corporation filed an S-1/A this afternoon disclosing the company’s decision to list on the NYSE under the symbol “FDC.” Earlier this week it was reported that First Data’s IPO could take place by the end of this month. The deal is expected to be at least $2.5bn, which would be the biggest in the U.S. this year.

Triton published a comprehensive Dossier on August 11, 2015. The Dossier includes a Triton Company Score, business model analysis, product analysis, bull vs. bear case scenarios, comparative analyses, management and director biographies, a historical valuation assessment, questions for management, and more.

Sep 10

2015Square IPO Coming in Q4

Square, the merchant services aggregator and mobile payment company, is reportedly planning to IPO in the fourth quarter of this year. Speculation has swirled in recent months that the company filed confidentially for an IPO, but Jack Dorsey’s involvement with Twitter has complicated matters. Bloomberg is now reporting that Square will press ahead with its IPO plans and Dorsey will remain the company’s CEO.

Square was last valued at $6bn in October 2014. Investors in the company include Government of Singapore Investment Corporation, Citi Ventures, Starbucks, Sequoia Capital and Richard Branson.

Square is a member of the Triton Research IPO Watchlist, a continuously updating database of companies we expect to either IPO or be acquired. The current IPO Watchlist is comprised of 109 companies organized by investment theme.

Sep 09

2015First Data’s $2.5bn IPO Accelerated

Bloomberg is reporting that First Data Corporation is preparing to seek at least $2.5bn in their IPO. The deal – which would be the biggest in the U.S. this year – could take place by the end of this month. Earlier reports had hinted at an October IPO. First Data filed its S-1 on July 20, 2015 and selected its bookrunners on August 26. 2015.

Triton published a comprehensive Dossier on August 11, 2015. The Dossier includes a Triton Company Score, business model analysis, product analysis, bull vs. bear case scenarios, comparative analyses, management and director biographies, a historical valuation assessment, questions for management, and more.

Sep 08

2015PointClickCare Filed for a $100m IPO

PointClickCare, a provider of cloud-based management software in the senior care industry, filed an S-1 for a $100m IPO on September 3, 2015. The company named J.P. Morgan, Goldman Sachs, and RBC Capital Markets as bookrunners. PointClickCare will list on the Nasdaq under the ticker symbol “PCLK.”

Company Description: PointClickCare sells cloud-based management software for senior care providers.

Competitive Set: McKesson, Epic Systems, Cerner, CareMerge, HealthMedx

Sep 05

2015Good Technology Bought by BlackBerry for $425m

Good Technology, a mobile security developer and provider, was acquired by BlackBerry yesterday for $425m in cash. The companies expect to close the deal by the end of November. Good Technology had previously filed for an IPO in May 2014, but recent reports have suggested the company was having trouble getting the deal to market.

Good Technology was scored 4.80 by Triton Research, which is the lowest Company Score in history.

Sep 01

2015Pure Storage Dossier Published

Triton Research has published a comprehensive Dossier on Pure Storage. The Dossier includes a Triton Company Score, fundamental model, business model analysis, product analysis, bull vs. bear case scenarios, comparative analyses, management and director biographies, a historical valuation assessment, questions for management, and more.

Pure Storage filed an S-1 with the SEC on August 12, 2015 and is expected to launch its roadshow next month. The company has not chosen an exchange but will list as “PSTG.”

Aug 26

2015First Data Selects Bookrunners

First Data selected 15 underwriters to lead its public offering yesterday. The company, which filed its S-1 on July 20, still has not stated how much it intends to raise or chosen a ticker or exchange. First Data is expected to raise several billion dollars, and will likely not launch its road show until October.

Aug 25

2015Fanatics Raised $300m From Silver Lake

Fanatics, an online seller of branded sports team gear, sold a minority ownership stake to Silver Lake for $300m. The company has been majority-owned by Kynetic LLC, an eBay spinoff. The investment is all for primary shares, meaning that existing Fanatics investors will hold onto their stock. It is not clear how large Silver Lake’s minority position would be, or if Kynetic would remain majority shareholder. The company has previously raised $450m in minority equity funding from Andreessen Horowitz, Insight Venture Partners, and Alibaba Group.

Kynetic is a member of the Triton Research IPO Watchlist, a continuously updating database of companies we expect to either IPO or be acquired. The current IPO Watchlist is comprised of 108 companies organized by investment theme.

Aug 20

2015ZocDoc Valued at $1.8bn

ZocDoc, the online booking platform for doctors, announced a $130m round of funding today. The raise valued the company at $1.8bn, making ZocDoc the third most valuable startup in New York. ZocDoc, which was founded in 2007, was last valued at $700m when it raised funding in 2011. Baillie Gifford and Atomico (the venture firm started by Skype co-founder Niklas Zennstrom) led the round. Existing investors in the company include Founders Fund, Jeff Bezos, Goldman Sachs, DST Global, and Khosla Ventures.

ZocDoc is a member of the Triton Research IPO Watchlist, a continuously updating database of companies we expect to either IPO or be acquired. The current IPO Watchlist is comprised of 108 companies organized by investment theme.

Aug 19

2015SoFi Valued at $4bn

Social Finance Inc. (SoFi), an online marketplace lender with a focus on student loan refinancing, has reportedly raised $1bn at a $4bn valuation. The round took place over the past few weeks and was led by SoftBank. SoFi, which was founded in 2011, had previously raised $766m from investors including Third Point Ventures, Discovery Capital, Peter Thiel, and Wellington Management.

SoFi is a member of the Triton Research IPO Watchlist, a continuously updating database of companies we expect to either IPO or be acquired. The current IPO Watchlist is comprised of 108 companies organized by investment theme.

Aug 18

2015Liberty Interactive to Purchase zulily

zulily, the flash-sales site for mothers, agreed to sell itself to Liberty Interactive yesterday in a deal that values the company at $2.4bn, or $18.75 a share in cash and stock. zulily, which traded as high as $73.50 last year, is now 15% below its $22.00 IPO price.

Aug 17

2015SoFi Hired A COO Ahead of Rumored IPO

SoFi, an online marketplace lender with a focus on student loan refinancing, hired digital media veteran Joanne Bradford as its chief operating officer today. This comes after reports in March that the company was preparing for a $500m IPO later this year. SoFi, which was founded in 2011, has raised $766m in total capital from investors including Third Point Ventures, Discovery Capital, Peter Thiel, and Wellington Management.

SoFi is a member of the Triton Research IPO Watchlist, a continuously updating database of companies we expect to either IPO or be acquired. The current IPO Watchlist is comprised of 108 companies organized by investment theme.

Aug 12

2015Pure Storage Inc. Filed for a $300m IPO

Pure Storage, a flash storage company, filed an S-1 for a $300m IPO today. The company named Morgan Stanley, Goldman Sachs, Barclays, and Allen & Company as bookrunners. This filing confirms speculation in April that Pure Storage was preparing to go public. The company was valued at $3bn in April 2014 and has raised over $470m from investors including Sutter Hill, Greylock, Redpoint, Index Ventures, T.Rowe Price, Fidelity and Wellington Management. The company has not chosen an exchange but will list as “PSTG.”

Company Description: Pure Storage sells solid-state enterprise storage hardware

Competitive Set: EMC, Hitachi Data Systems, HGST (Western Digital), NetApp, HP

Aug 11

2015First Data Dossier Published

Triton Research has published a comprehensive Dossier on First Data Corporation. The Dossier includes a Triton Company Score, business model analysis, product analysis, bull vs. bear case scenarios, comparative analyses, management and director biographies, a historical valuation assessment, questions for management, and more.

First Data filed an S-1 with the SEC on July 20, 2015 and is expected to launch its roadshow next month.

Aug 06

2015HelloFresh Planning To IPO This Year

HelloFresh, a food delivery startup, is reportedly preparing for an IPO this year. The offering may take place as early as October and could value the company at over $1.1bn. Morgan Stanley and Goldman Sachs have been tapped to organize the listing. HelloFresh, which was founded in 2011, has raised over $193m in funding. Rocket Internet is a majority investor in the company, and other backers include Insight Venture Partners, Phenomen Ventures and Vorwerk Direct Selling Ventures.

HelloFresh is a member of the Triton Research IPO Watchlist, a continuously updating database of companies we expect to either IPO or be acquired. The current IPO Watchlist is comprised of 108 companies organized by investment theme.

Aug 05

2015Uber Financial Metrics Leaked

Confidential Uber financial documents were leaked to Gawker today. The documents appear to show Uber’s profits and losses for 2012, 2013, and some of 2014. According to the documents, Uber reported an annual net revenue of $16.1m in 2012, $104.4m in 2013, and $102.6m in the first half of 2014. Total losses have grown from $56.5m in 2013 to $161.1m in the first half of 2014.

Uber has raised over $6bn from investors since since the company was founded in 2009. The company was most recently valued at $51bn.

Uber is a member of the Triton Research IPO Watchlist, a continuously updating database of companies we expect to either IPO or be acquired. The current IPO Watchlist is comprised of 108 companies organized by investment theme.

Aug 03

2015Uber Valued at $51bn, Snapdeal Valued at $5bn

Uber Technologies, the mobile car-booking company, is now valued at $51bn. The company raised $1bn in a round led by Microsoft, who invested $100m. Uber was previously valued at $40bn when it raised money in February 2015. Uber has now raised $6.9bn since the company was founded in 2009.

Snapdeal, the Indian ecommerce startup, is reportedly raising $500m at a $5bn valuation. The raise is being led by Alibaba, with Foxconn and previous investor Softbank also participating. Snapdeal, which was founded in 2010, has raised $1.1bn in total capital from investors such as eBay, Softbank, Intel and Blackrock.

Uber and Snapdeal are members of the Triton Research IPO Watchlist, a continuously updating database of companies we expect to either IPO or be acquired. The current IPO Watchlist is comprised of 108 companies organized by investment theme.

Jul 30

2015SimpliVity Planning A 2016 IPO

SimpliVity, a software startup that helps companies manage their hardware, is reportedly planning to IPO in the first quarter of 2016. CEO Doron Kempel said in an interview that the six-year-old company is leaning toward Morgan Stanley as an underwriter. SimpliVity was last valued at over $1bn in March and has raised $276m in total capital. Investors in the company include Accel Partners, Charles River Ventures, DFJ Growth, Kleiner Perkins Caufield & Byers Growth, Waypoint Capital and Meritech Capital Partners.

SimpliVity is a member of the Triton Research IPO Watchlist, a continuously updating database of companies we expect to either IPO or be acquired. The current IPO Watchlist is comprised of 108 companies organized by investment theme.

Jul 30

2015GitHub Added to Triton’s IPO Watchlist

GitHub, a software code hosting and collaboration platform, has been added to the Triton IPO Watchlist. The company announced on July 29, 2015 that it had raised a $250m funding round at a valuation of approximately $2bn. Sequoia Capital led the round, with Andreessen Horowitz, Thrive Capital and Institutional Venture Partners also participating. GitHub, which was founded in 2008, has raised a total of $350m in outside funding.

GitHub is a member of the Triton Research IPO Watchlist, a continuously updating database of companies we expect to either IPO or be acquired. The current IPO Watchlist is comprised of 108 companies organized by investment theme

Jul 29

2015First Data Corporation Reported Q2 Results

First Data Corporation reported Q2 results this afternoon. The company saw a slight increase in revenue (1%) and adjusted EBITDA (3%) compared to the same quarter of 2014. First Data filed an S-1 with the SEC on July 20, 2015 and is reportedly in the midst of interviewing bankers for its IPO.

Company Description: First Data provides payment processing services, as well as point-of-sale, analytics, and security software.

Competitive Set: Worldpay, Global Payments, Heartland Payment Systems, Vantiv, Square, Paypal, MICROS (Oracle)

Jul 28

2015Stripe Valued at $5bn

Stripe, a digital payments startup, received an investment from Visa that values the company at $5bn. The investment is part of a larger round that includes Kleiner Perkins, American Express, and Sequoia Capital. Stripe was last valued at $3.5bn in May. Stripe and Visa also signed a commercial agreement in which the two companies will work closely on initiatives around payments security and new product innovation.

Stripe is a member of the Triton Research IPO Watchlist, a continuously updating database of companies we expect to either IPO or be acquired. The current IPO Watchlist is comprised of 106 companies organized by investment theme.

Jul 24

2015Vizio Inc. Filed for a $173m IPO

Vizio Inc. filed an S-1 with the SEC today for a proposed IPO of its common stock. The company has not chosen an exchange but will list as “VZIO.”

Company Description: Consumer electronics company.

Competitive Set: Samsung, Sony, LG, Sharp, Toshiba, Panasonic, Funai

Jul 24

2015Square Said to File for IPO

Square, the merchant services aggregator and mobile payment company, has reportedly filed confidentially for an IPO. This news comes after Forbes reported last month that Square is preparing for a public offering. The company declined to comment on the news. Square was last valued at $6bn in October 2014. Investors in the company include Government of Singapore Investment Corporation, Citi Ventures, Starbucks, Rizvi Traverse Management and Richard Branson.

Square is a member of the Triton Research IPO Watchlist, a continuously updating database of companies we expect to either IPO or be acquired. The current IPO Watchlist is comprised of 106 companies organized by investment theme.

Jul 24

2015Palantir Worth $20bn, Airbnb Hiring a CFO

Palantir, the secretive data and analytics company, disclosed a new fundraising round to the SEC yesterday. The company issued $500mn worth of stock and has sold $450m so far. This confirms recent reports that Palantir was doing a raise at a $20bn valuation. Palantir is now the 4th most highly valued startup in the world behind Uber Technologies, Airbnb and Xiaomi. Investors in Palantir include Founders Fund, 137 Ventures, Glynn Capital Management, Tiger Global Management and Reed Elsevier Ventures.

Airbnb, the online room rental service, is reportedly in talks to hire Blackstone’s CFO Laurence Tosi. Airbnb hasn’t had a CFO since Andrew Swain left the company in September 2014. Airbnb is reportedly in the process of raising $1bn at a $24bn valuation. Investors in Airbnb include Andreessen Horowitz, Sequoia Capital, Greylock Partners, SV Angel, TPG, T. Rowe Price, and DST.

Palantir and Airbnb are members of the Triton Research IPO Watchlist, a continuously updating database of companies we expect to either IPO or be acquired. The current IPO Watchlist is comprised of 106 companies organized by investment theme.

Jul 20

2015First Data Corporation Filed for an IPO

First Data Corporation filed an S-1 with the SEC today for a proposed IPO of its common stock. The company filed for a $100m offering, but this amount is likely a placeholder.

Company Description: First Data provides payment processing services, as well as point-of-sale, analytics, and security software.

Competitive Set: Worldpay, Global Payments, Heartland Payment Systems, Vantiv, Square, Paypal, MICROS (Oracle)

Jul 20

2015Apptio Hired Banks for an IPO

Apptio, a cloud-based software startup that helps companies analyze their spending on technology, is reportedly preparing for an IPO. Apptio hired Goldman Sachs, J.P. Morgan and Bank of America to lead the offering. The company – which last month named co-founder Kurt Shintaffer as chief financial officer – is expected to be valued at $1bn. Apptio has raised $136m in total funding from Janus Capital, T. Rowe Price, The Hillman Comparies, Greylock Partners, Andreessen Horowitz, and others.

Apptio is a member of the Triton Research IPO Watchlist, a continuously updating database of companies we expect to either IPO or be acquired. The current IPO Watchlist is comprised of 106 companies organized by investment theme.

Jul 14

2015FanDuel raising $275m at a valuation of over $1bn

FanDuel, the market leader in the daily fantasy sports industry, has reportedly raised $275m in Series E financing, bringing the company’s total capital raised to $363m at a valuation of over $1bn. The latest funding round was oversubscribed and led by KKR with Google Capital and Time Warner Investments. Previous investors Shamrock Capital, NBC Sports Ventures, Comcast Ventures, Bullpen Capital, Pentech Ventures and Piton Capital re-invested in FanDuel during the Series E raise.

Jul 06

2015Rapid7 IPO Terms Set: 6.45m Shares at $13 – $15 Per Share

Rapid7 Inc. filed an amended registration with the SEC for its IPO this afternoon. The company plans to sell 6.45m primary shares and sees an offering price of $13 – $15 per share. Rapid7 will list on the Nasdaq under the symbol “RPD.”

Triton Research published a 79-page report on Rapid7, Inc. containing a bottom-up financial model, product analysis, business model analysis, bull vs. bear case scenarios, comparative analyses, questions for management, historical capitalization, historical valuations, and more. For pricing information please call (212) 804-6151.

Triton Research Company Score (avg. 6.56): Contact Triton Research for more details.

Company Description: Develops and sells security software and services to enterprises and medium-sized businesses in a number of ways; 1) licensed software with associated, subscription-based content and maintenance, 2) cloud-based software services, and 3) managed services where it operates the software for its customers. The Company also sells professional services.

Competitive Set: Qualys, Tenable Network Security, McAfee (IBM), IBM, Veracode

Jul 06

2015MongoDB Hires New CFO

MongoDB, a NoSQL database software company, announced Michael Gordon as its Chief Financial Officer this morning. Gordon replaces previous CFO Sydney Carey, who left MongoDB in February for venture-backed security company Zscaler. Mr. Gordan joins MongoDB from Yodle, a venture-backed online marketing company for local businesses that filed for an IPO in July 2014 but has yet to go public. He was both the chief operating officer and chief financial officer and said he wasn’t looking to leave.

MongoDB raised $80m last December at a rumored $1.6bn valuation. Investors in the company include Goldman Sachs, Altimeter Capital, NEA, Sequoia and T. Rowe Price Associates.

MongoDB is a member of the Triton Research IPO Watchlist, a continuously updating database of companies we expect to either IPO or be acquired. The current IPO Watchlist is comprised of 106 companies organized by investment theme

Jul 02

2015InnoLight Technology Dossier Published by Triton Research

Triton Research has published a 64-page Dossier on InnoLight Technology Corporation. Our analysis contains a bottom-up financial model, product analysis, business model analysis, bull vs. bear case scenarios, comparative analyses, questions for management, historical capitalizations, historical valuations, and more.

InnoLight filed an S-1 with the SEC on June 18, 2015 for an IPO of its common stock. The company plans to list on the Nasdaq under the ticker INLT.

Company Description: Designs, manufactures, and sells high-performance optical transceivers (for use in data communications over fiber optic cable) to organizations with data centers.

Competitive Set: Finisar, Cisco, Brocade, Dell, Transition Networks

Jun 30

2015Uber Term Sheet Leaked – Reveals $470m in Operating Losses

An Uber term sheet was leaked to Bloomberg News yesterday. The document, which is being used to sell $1bn – $1.2bn in convertible bonds, reveals that the company generated $470m in operating losses on $415m in revenue. The term sheet also states 300% year-over-year growth. An Uber spokeswoman claimed that the disclosed numbers are “substantially old [and] do not reflect business activities today.”

Last week it was reported that the deal is being led by Hillhouse Capital Management. The leaked document shows that investors will be able to convert the notes at a compounded 11.5% discount if the company sells shares on the public market. The bonds mature in 2022, with an 8% annual return if held through maturity. Uber reportedly aims to complete the deal by June 30, 2015.

Uber is a member of the Triton Research IPO Watchlist, a continuously updating database of companies we expect to either IPO or be acquired. The current IPO Watchlist is comprised of 106 companies organized by investment theme.

Jun 29

2015HelloFresh Added to Triton Research IPO Watchlist

HelloFresh, a food delivery startup, has been added to the Triton Research IPO Watchlist. Press reports suggest that the company is considering an initial public offering this year and is in dialogue with Morgan Stanley and Goldman Sachs about advising. HelloFresh has raised $193.5m in total capital since its inception in 2011. The company is backed by Rocket Internet, Insight Venture Partners, Phenomen Ventures and Vorwerk Direct Selling Ventures.

HelloFresh is a member of the Triton Research IPO Watchlist, a continuously updating database of companies we expect to either IPO or be acquired. The current IPO Watchlist is comprised of 106 companies organized by investment theme.

Jun 29

2015Jun 29

2015Jun 25

2015Match Group Added to Triton Research IPO Watchlist

Match Group, an online dating business owned by media conglomerate IAC, has been added to Triton Research’s IPO Watchlist. IAC announced today that it was planning to pursue an initial public offering for Match Group in the fourth quarter of this year.

Match Group holds a variety of popular dating websites and apps including Match.com, Tinder and OkCupid. The IPO will consist of less than 20 percent of IAC common stock, and IAC will retain a stake in Match Group. Match Group accounted for $239.2m of IAC’s revenue of $772.5m in the first quarter.

Match Group is a member of the Triton Research IPO Watchlist, a continuously updating database of companies we expect to either IPO or be acquired. The current IPO Watchlist is comprised of 106 companies organized by investment theme.

Jun 25

2015WeWork Valuation Doubled to $10bn in Six Months

WeWork Companies Inc., a provider of shared office space to small companies and technology startups, was valued at $10bn yesterday after Fidelity and existing investors put $400m of capital into the company. This valuation is double WeWork’s $5bn value in December 2014, and dwarfs the company’s $1.5bn valuation at the start of last year. CEO Adam Neumann said the company hadn’t been looking for additional funding, but received inquiries from numerous investors.

WeWork is a member of the Triton Research IPO Watchlist, a continuously updating database of companies we expect to either IPO or be acquired. The current IPO Watchlist is comprised of 106 companies organized by investment theme.

Jun 24

2015Rapid7 Dossier Published by Triton Research

Rapid7 filed an S-1 with the SEC on June 11, 2015. The company plans to list on the Nasdaq under the symbol “RPD.”

Triton Research published a 79-page report on Rapid7, Inc. containing a bottom-up financial model, product analysis, business model analysis, bull vs. bear case scenarios, comparative analyses, questions for management, historical capitalization, historical valuations, and more. For pricing information please call (212) 804-6151.

Triton Research Company Score (avg. 6.56): Contact Triton Research for more details.

Company Description: Develops and sells security software and services to enterprises and medium-sized businesses in a number of ways; 1) licensed software with associated, subscription-based content and maintenance, 2) cloud-based software services, and 3) managed services where it operates the software for its customers. The Company also sells professional services.

Competitive Set: Qualys, Tenable Network Security, McAfee (IBM), IBM, Veracode

Jun 24

2015Palantir Now Valued at $20bn

Palantir Technologies, the secretive data and analytics company, is reportedly raising $500m at a $20bn valuation. This round would make the company the third most valuable startup in the United States behind Uber and Airbnb. Palantir was valued at $9bn in December 2013 and was reported to be worth $15bn late last year. Current investors in Palantir include Founders Fund, 137 Ventures, Glynn Capital Management, Tiger Global Management and Reed Elsevier Ventures.

Palantir is a member of the Triton Research IPO Watchlist, a continuously updating database of companies we expect to either IPO or be acquired. The current IPO Watchlist is comprised of 106 companies organized by investment theme.

Jun 24

2015Credit Karma Valued at $3.5bn and Planning an IPO

Credit Karma, the online credit score provider and credit marketplace, announced a raise of $175m at a $3.5bn valuation today. Investors in the round include Tiger Global Management, Valinor Management and Viking Global Investors. Credit Karma has now raised $368.5m in total capital. TechCrunch is also reporting that the company, which was founded in 2008, is on track to file for an IPO within the next year and a half.

Credit Karma is a member of the Triton Research IPO Watchlist, a continuously updating database of companies we expect to either IPO or be acquired. The current IPO Watchlist is comprised of 106 companies organized by investment theme.

Jun 18

2015InnoLight Technology Filed for a $100m IPO

InnoLight filed an S-1 with the SEC this morning for a proposed IPO of its common stock. The company plans to list on the Nasdaq under the ticker INLT.

Company Description: Sells hardware components (primarily optical transceiver) for fiber-optic communications.

Competitive Set: Finisar, Avago Technologies, JDS Uniphase, Sumitomo Electric, Honeywell, Belden, Perle

Jun 18

2015Airbnb Raising $1bn at a $24bn Valuation

Airbnb, the online room rental service, is reportedly looking to close a $1bn funding round at a $24bn valuation by the end of June. The company is telling investors to expect $850m in revenue in 2015 and $10bn by 2020. Airbnb was last valued at $13bn. Previous investors in the company include TPG, T. Rowe Price, Dragoneer, Founders Fund, Sequoia, DST and more.

Airbnb is a member of the Triton Research IPO Watchlist, a continuously updating database of companies we expect to either IPO or be acquired. The current IPO Watchlist is comprised of 106 companies organized by investment theme.

Jun 17

2015Spotify Hired A New CFO

Spotify, a music streaming service, has hired Barry McCarthy as CFO. McCarthy, who is a member of the Spotify board and is stepping down, previously served as Netflix CFO until resigning in 2010 to pursue “broader executive opportunities.” This hire comes one week after Spotify closed a $526m round of funding at a $8.53bn valuation.

Spotify is a member of the Triton Research IPO Watchlist, a continuously updating database of companies we expect to either IPO or be acquired. The current IPO Watchlist is comprised of 106 companies organized by investment theme.

Jun 16

2015AppFolio Dossier Published: Company Score Revised Higher

Triton Research revised our AppFolio Inc. Company Score higher to reflect AppFolio’s amended registration with the SEC on June 15, 2015. AppFolio plans to sell 6.2m shares and sees an offering price of $12 – $14 per share. AppFolio will list under the symbol “APPF” and will list on the Nasdaq.

Triton Research has published a 65-page Dossier on AppFolio Inc. For pricing information please contact Kaylan Tildsley at (212) 804-6151.

Triton Research Company Score (avg. 6.56): Contact Triton Research for more details.

Company Description: Develops and sells cloud-based software services, on a subscription-basis, that automates business activities for small & medium businesses that manage property or provide legal services. AppFolio also sells related professional services and electronic payment services.

Competitive Set: Yardi, Easyrent, Property Solutions, Buildium, MRI Software

Jun 16

2015FitBit Price Range Raised to $17 – $19 Per Share, Deal Upsized

FitBit Inc. raised its price range for shares in its IPO to $17 – $19 from $14 – $16. The deal – which is slated to price tomorrow night – was also upsized to 34.5m shares. FitBit will list on the NYSE under the symbol “FIT.

Triton Research has published a 72-page Dossier on Fitbit Inc. For pricing information please contact Kaylan Tildsley at (212) 804-6151.

Triton Research Company Score (avg. 6.55): Contact Triton Research for more details.

Company Description: Designs and sells electronic fitness activity trackers and associated software to consumers and corporations as well as related software services (virtual coaching and content).

Competitive Set: Garmin, Jawbone, Misfit, Adidas, Nike, Apple, Archos, Microsoft, Samsung

Jun 15

2015Ooma Filed For a $100 IPO

Ooma, a consumer telecommunications company, filed an S-1 with the SEC today for a proposed IPO of its common stock. The company plans to list on the NYSE under the ticker OOMA.

Ooma is a member of the Triton Research IPO Watchlist, a continuously updating database of companies we expect to either IPO or be acquired. The current IPO Watchlist is comprised of 106 companies organized by investment theme.

Jun 15

2015Xactly Dossier Published: Company Score Revised Higher

Triton Research revised our Xactly Inc. Company Score higher to reflect Xactly’s amended registration with the SEC on June 15, 2015. Xactly plans to sell 7m shares and sees an offering price of $10 – $12 per share. Xactly will list under the symbol “XTLY” and will list on the NYSE.

Triton Research has published a 69-page Dossier on Xactly Inc. For pricing information please contact Kaylan Tildsley at (212) 804-6151.

Triton Research Company Score (avg. 6.55): Contact Triton Research for more details.

Company Description: Develops and sells cloud-based software and associated services that help companies manage employee compensation and performance (primarily sales employees) and are sold on a subscription basis.

Competitive Set: Anaplan, Beqom, Zoho, CallidusCloud, Netsuite, Cornerstone OnDemand

Jun 15

2015AppFolio IPO Terms Set: 6.2m Shares at $12 – $14 Per Share

AppFolio Inc. filed an amended registration with the SEC for its IPO this morning. The company plans to sell 6.2m shares and sees an offering price of $12 – $14 per share. AppFolio will list under the symbol “APPF” and will list on the Nsadaq.

Triton Research published a 65-page Dossier on AppFolio Inc. on June 1, 2015. Our Triton Research Company Score for AppFolio is now under review. For pricing information please contact Kaylan Tildsley at (212) 804-6151.

Triton Research Company Score (avg. 6.55): Contact Triton Research for more details.

Company Description: Develops and sells cloud-based software services, on a subscription-basis, that automates business activities for small & medium businesses that manage property or provide legal services. AppFolio also sells related professional services and electronic payment services.

Competitive Set: Yardi, Easyrent, Property Solutions, Buildium, MRI Software

Jun 15

2015Xactly IPO Terms Set: 7m Shares at $10 – $12 Per Share

Xactly Inc. filed an amended registration with the SEC for its IPO this morning. The company plans to sell 7.04m shares and sees an offering price of $10 – $12 per share. Xactly will list under the symbol “XTLY” and will list on the NYSE.

Triton Research published a 69-page Dossier on Xactly Inc. on June 8, 2015. Our Triton Research Company Score for Xactly is now under review. For pricing information please contact Kaylan Tildsley at (212) 804-6151.

Triton Research Company Score (avg. 6.55): Contact Triton Research for more details.

Company Description: Develops and sells cloud-based software and associated services that help companies manage employee compensation and performance (primarily sales employees) and are sold on a subscription basis.

Competitive Set: Anaplan, Beqom, Zoho, CallidusCloud, Netsuite, Cornerstone OnDemand

Jun 13

2015Square Planning To IPO This Year

Square, the merchant services aggregator and mobile payment company, will reportedly go public this year. FORBES reports that Square is planning to file a confidential registration statement – a person familiar with the matter said “it’s going to happen soon, if it hasn’t happen already.” Square last raised money in October 2014 at a $6bn valuation.

Square is a member of the Triton Research IPO Watchlist, a continuously updating database of companies we expect to either IPO or be acquired. The current IPO Watchlist is comprised of 106 companies organized by investment theme.

Jun 11

2015Rapid7 Filed for a $80m IPO

Rapid7 filed an S-1 with the SEC today for a proposed IPO of its common stock. The company plans to list on the Nasdaq under the ticker RPD.

Company Description: Sells security software and related services to enterprises.

Competitive Set: Qualys, Tenable Network Security, Barracuda Networks, FireEye, McAfee (Intel), IBM

Jun 10

2015Spotify Closes Funding Round – Now Valued at $8.53bn

Spotify, a music streaming service, closed a $526m round of funding yesterday. The financing – which was first reported in April – valued the company at $8.53bn. Investors in Spotify’s latest round include Discovery Capital Management, Senvest Capital, Baillie Gifford, Landsdowne Partners, and Rinkelberg Capital. This raise comes on the heels of the launch of Apple Music this past Monday.

Spotify is a member of the Triton Research IPO Watchlist, a continuously updating database of companies we expect to either IPO or be acquired. The current IPO Watchlist is comprised of 106 companies organized by investment theme.

Jun 09

2015MINDBODY Dossier Published: Company Score Revised Higher

Triton Research revised our MINDBODY Company Score higher to reflect MINDBODY’s amended registration with the SEC on June 8, 2015. MINDBODY plans to sell 7.15m shares and sees an offering price of $13 – $15 per share. MINDBODY will list under the symbol “MB” and has applied to list on the Nasdaq Global Market.

Triton Research published a 67-page Dossier on MINDBODY Inc. on May 22, 2015. For pricing information please contact Kaylan Tildsley at (212) 804-6151.

Triton Research Company Score (avg. 6.55): Contact Triton Research for more details.

Company Description: Develops and sells enterprise resource planning software to small and medium businesses in the health and beauty industry (gyms, salons, spas, etc.) on a subscription-basis, and point-of-sale hardware on a unit basis. The Company also runs a marketplace for 3rd-party software providers to sell add-ons to MINDBODY subscribers.

Competitive Set: Square, Intuit, SalonBiz, SpaBooker, Shopify, Zen Planner, Front Desk

Jun 08

2015Xactly Dossier Published

Triton Research published a 69-page Dossier on Xactly, Inc. containing a bottom-up financial model, product analysis, business model analysis, bull vs. bear case scenarios, comparative analyses, questions for management, historical capitalizations, historical valuations, and more. For pricing information please contact Kaylan Tildsley at (212) 804-6151.

Triton Research Company Score (avg. 6.56): Contact Triton Research for more details.

Company Description: Develops and sells cloud-based software and associated services that help companies manage employee compensation and performance (primarily sales employees) and are sold on a subscription basis.

Competitive Set: Anaplan, Beqom, Zoho, CallidusCloud, Netsuite, Cornerstone OnDemand

Jun 08

2015Delivery Hero Raised $110m at a $3.1bn Valuation

Delivery Hero, a takeout food service based in Berlin, raised $110m at a valuation of over $3.1bn. Investors in the round were not named, but described as “leading public market investors” out of the U.S. This round brings total capital raised by the company to $1bn, with nearly $600m raised this year. Previous investors in Delivery Hero include Insight Venture Partners, General Atlantic, and Rocket Internet.

Delivery Hero CEO Niklas Östberg told TechCrunch that he thinks the company is in a position to IPO this year, but wants to “wait until we see a clear benefit from it.”

Delivery Hero is a member of the Triton Research IPO Watchlist, a continuously updating database of companies we expect to either IPO or be acquired. The current IPO Watchlist is comprised of 106 companies organized by investment theme.

Jun 08

2015MINDBODY Sets IPO Terms: 7.15m Shares at $13 – $15 Per Share

MINDBODY Inc. filed an amended registration with the SEC for its IPO this morning. The company plans to sell 7.15m shares and sees an offering price of $13 – $15 per share. MINDBODY will list under the symbol “MB” and has applied to list on the Nasdaq Global Market.

Triton Research published a 67-page Dossier on MINDBODY Inc. on May 22, 2015. Our Triton Research Company Score for MINDBODY is now under review. For pricing information please contact Kaylan Tildsley at (212) 804-6151.

Triton Research Company Score (avg. 6.56): Contact Triton Research for more details.

Company Description: Develops and sells enterprise resource planning software to small and medium businesses in the health and beauty industry (gyms, salons, spas, etc.) on a subscription-basis, and point-of-sale hardware on a unit basis. The Company also runs a marketplace for 3rd-party software providers to sell add-ons to MINDBODY subscribers.

Competitive Set: Square, Intuit, SalonBiz, SpaBooker, Shopify, Zen Planner, Front Desk

Jun 03

2015Coupang Received $1 Billion from SoftBank

Coupang, a Korean online retailer, received a $1bn investment from SoftBank Corp. at a $5bn valuation yesterday. This deal is the largest Internet investment in South Korea’s history. Coupang has raised $1.4bn in total capital since its inception in 2010, most recently $300m from Blackrock in December 2014. Other investors in the company include Sequoia Capital, Wellington Management Company, and Illuminate Ventures.

Coupang is a member of the Triton Research IPO Watchlist, a continuously updating database of companies we expect to either IPO or be acquired. The current IPO Watchlist is comprised of 106 companies organized by investment theme.

Jun 02

2015Fitbit Dossier Published – Company Score Revised

Triton Research revised our Fitbit Company Score lower to reflect Fitbit’s amended registration with the SEC this morning. Fitbit plans to sell 29.9m shares at an offering price of $14 – $16 per share. Fitbit will list on the NYSE under the symbol “FIT.”

Triton Research published a 72-page report on Fitbit Inc. containing a bottom-up financial model, product analysis, business model analysis, bull vs. bear case scenarios, comparative analyses, questions for management, historical capitalizations, historical valuations, and more. For pricing information please contact Kaylan Tildsley at (212) 804-6151.

Jun 02

2015Fitbit Sets IPO Terms: 29.9m Shares at $14 – $16 Per Share

FitBit Inc. filed an amended registration with the SEC for its IPO this morning. The company plans to sell 29.9mn Shares (22.4m Primary/7.5mn Secondary) and sees an offering price of $14 – $16 per share. FitBit will list on the NYSE under the symbol “FIT.

Triton Research published a 72-page Dossier on Fitbit Inc. containing a bottom-up financial model, product analysis, business model analysis, bull vs. bear case scenarios, comparative analyses, questions for management, historical capitalizations, historical valuations, and more. For pricing information please contact Kaylan Tildsley at (212) 804-6151.

May 29

2015Snapchat Raising Money at a $16bn Valuation

Snapchat, the ephemeral messaging service, is reportedly raising money at a $16bn valuation. Potential investors in the $650mn round include Fidelity, Alibaba, Glade Brook Capital and York Capital. CEO Evan Spiegel revealed plans for an eventual IPO earlier this week. Snapchat – which was valued at $15bn in March – has raised $848m in total capital since it was founded in 2011.

Snapchat is a member of the Triton Research IPO Watchlist, a continuously updating database of companies we expect to either IPO or be acquired. The current IPO Watchlist is comprised of 106 companies organized by investment theme.

May 27

2015Snapchat Planning for IPO

Snapchat, the ephemeral messaging service, is reportedly planning an IPO. CEO Evan Spiegel said yesterday at the Re/code Conference in L.A., “We need to IPO. We have a plan to do that.” Snapchat, which declined Facebook’s $3bn acquisition offer in 2013, was last valued at $10bn in December. It was reported this past February that Snapshat was looking to raise $500m at a $19bn valuation.

Snapchat is a member of the Triton Research IPO Watchlist, a continuously updating database of companies we expect to either IPO or be acquired. The current IPO Watchlist is comprised of 106 companies organized by investment theme.

May 26

2015Alarm.com Filed for a $75mn IPO

Alarm.com Holdings filed an S-1 with the SEC on May 22, 2015 for a proposed IPO of its common stock. The company plans to list on the Nasdaq under the ticker ALRM.

Company Description: Alarm.com sells home security and home automation hardware and management software.

Competitive Set: Nest Labs (Google), AT&T, Comcast, iControl Networks, Leviton, Samsung, ADT, Honeywel

May 22

2015Hootsuite IPO Coming Soon

Hootsuite Media, a platform for enterprises to manage their presence on social media sites, is contemplating moving up its IPO timeline after Shopify’s positive debut yesterday. Ryan Holmes, the CEO of Hootsuite, said “I’ve talked about 18 to 24 months [until an IPO], but I’m very bullish given the success that Shopify has had, and maybe we will want to speed that up a little bit.” Hootsuite last raised $60m in September, bringing total financing to date to $250m.

Hootsuite is a members of the Triton Research IPO Watchlist, a continuously updating database of companies we expect to either IPO or be acquired. The current IPO Watchlist is comprised of 106 companies organized by investment theme.

May 21

2015Stripe Raising Money at a $5bn Valuation Seven Months After Raising at a $3.5bn Valuation

Stripe, a payments startup, is reportedly in talks to raise an undisclosed sum of money at a $5bn valuation. This comes less than seven months after Stripe announced a $70m round that valued the company at $3.5bn. Stripe has raised $190m in total capital to date. Investors in Stripe include Thrive Capital, Sequoia Capital, General Catalyst, Founders Fund and Khosla Ventures.

Stripe is a member of the Triton Research IPO Watchlist, a continuously updating database of companies we expect to either IPO or be acquired. The current IPO Watchlist is comprised of 106 companies organized by investment theme.

May 19

2015Xactly Filed For An IPO

Xactly filed an S-1 with the SEC today for a proposed IPO of its common stock. The company plans to list on the NYSE under the ticker XTLY.

Company Description: Xactly sells cloud-based software to Enterprises and SMBs for managing sales commissions and analyzing sales team performance.

Competitive Set: NetSuite, Cornerstone Software, QCommission, Anaplan, Plex Systems, CallidusCloud

May 19

2015Flipkart Now Valued at $15.5bn

Flipkart, India’s largest e-commerce site, is now valued at $15.5bn after raising $550m from existing investors. This raise – which was led by Tiger Global Management – makes Flipkart the third most valuable privately-held startup company in the world. Flipkart has now raised over $3bn in total capital from investors such as Accel Partners, T. Rowe Price Associates, DST Global, Naspers, GIC, and Qatar Investment Authority.

Flipkart is a members of the Triton Research IPO Watchlist, a continuously updating database of companies we expect to either IPO or be acquired. The current IPO Watchlist is comprised of 106 companies organized by investment theme.

May 18

2015AppFolio Filed For An IPO

AppFolio filed an S-1 with the SEC today for a proposed IPO of its common stock. The company plans to list on the Nasdaq under the ticker APPF.

Company Description: AppFolio sells web-based software to SMB property management companies. The software includes tools for vacancy posting, work-order management, online rent collection, applicant screening, and other operations.

Competitive Set: Yardi, Easyrent, Property Solutions, Buildium, MRI Software

May 18

2015Fitbit Dossier Published by Triton Research

Triton Research published a 72-page Dossier on Fitbit Inc. containing a bottom-up financial model, product analysis, business model analysis, bull vs. bear case scenarios, comparative analyses, questions for management, historical capitalizations, historical valuations, and more. For pricing information please contact Kaylan Tildsley at (212) 804-6151.

Triton Research Company Score (avg. 6.57): Contact Triton Research for more details.

Company Description: Designs and sells electronic fitness activity trackers and associated software to consumers and corporations as well as related software services (virtual coaching and content).

Competitive Set: Garmin, Jawbone, Misfit, Adidas, Nike, Apple, Archos, Microsoft, Samsung

May 12

2015DocuSign Valued at $3bn, Blue Apron Valued at $2bn

DocuSign, the digital signature software company, raised $233m at a $3bn valuation. This round – which brings total capital to over $440bn – is almost double the $1.6bn valuation DocuSign took in March 2014. Brookside Capital led the round and was joined by Generation Investment Management, ClearBridge Investments, Iconiq Capital, Wasatch Advisors, Wellington Management, and Sands Capital Ventures. Existing investors in Docusign include strategic funds such as Google Ventures, SAP Ventures, VISA, Salesforce, Samsung Venture Investment Corp., Telstra and Comcast.

Blue Apron, a meal-kit delivery startup, is reportedly in talks to raise money at a valuation of ~$2bn. The company – which raised $50m in April 2014 at a $500m valuation – is seeking to raise more than $100m from investors. Fidelity is rumored to be participating in the round. Existing investors in Blue Apron include Bessemer Venture Partners, First Round Capital, the Stripes Group and Box Group.

DocuSign and Blue Apron are members of the Triton Research IPO Watchlist, a continuously updating database of companies we expect to either IPO or be acquired. The current IPO Watchlist is comprised of 106 companies organized by investment theme.

May 11